Blogs

Unless you file the get back by the deadline (and extensions), you might have to shell out faltering-to-document penalty. The brand new punishment is dependant on the brand new income tax perhaps not paid by the deadline (instead of reference to extensions). The new penalty can be 5% for every week or part of thirty days you to an income is late, yet not more 25%. If you don’t file their come back and pay their taxation by the due date, you might have to pay a penalty. You can also need to pay a penalty for those who significantly understate their taxation, file a frivolous income tax submission, otherwise are not able to also have the TIN. For many who give fraudulent information regarding their come back, you may need to shell out a civil con penalty.

Real estate

While you are trying to find no-costs otherwise low-rates medical care exposure guidance, see the « Yes » container to the Setting 540, Side 5. High-Path Cannabis Tax Borrowing – To own nonexempt years birth to the otherwise once January step one, 2023, and you may before January step 1, 2028, the brand new Highest-Path Cannabis Taxation Credit (HRCTC) will be available to subscribed industrial marijuana companies that meet up with the certification. The financing are allowed to a professional taxpayer within the an expense comparable to twenty five% out of qualified expenditures from the nonexempt seasons. A myriad of entities, apart from excused teams, meet the requirements to allege that it credit. If you don’t be considered because the an innocent spouse and break up from liability, you may also qualify for fair save if you’re able to show that, offered the small print and you will items, do not end up being held accountable for people understatement otherwise underpayment out of tax.

These types of services are very minimal and generally were merely on-university functions, basic education, and you will financial adversity a career. The customer have to report and you can pay along side withheld taxation inside 20 months following transfer using Form 8288. This type is actually filed for the Internal revenue service that have duplicates An excellent and you will B away from Form 8288-An excellent. Backup B associated with the statement was stamped obtained by Internal revenue service and you may gone back to you (the vendor) in case your declaration is complete and you may boasts your TIN. You need to file Duplicate B along with your taxation go back to bring borrowing from the bank to the taxation withheld.

Withholding for the Grants and you will Fellowship Gives

Would be to a resident have to difficulty the procedure, landlords will likely earliest ask a discussion to the occupant gamblerzone.ca over here to help you arrive at an agreement. If it goes wrong, renters might take the case to small claims court, according to the state where it alive. Roost links with Yardi, Entrata, and you will RealPage so you can streamline put payments, refunds, and you will recovery.

If the inactive try hitched in the course of death, a new return to your thriving mate have to be registered with the newest submitting status \ »single\ » unless she or he remarried s before the end of your taxable 12 months. As well, a joint go back can be submitted on the season from demise when the both taxpayer and you can partner is dead and both fiduciaries agree so you can file a mutual get back. Registration having Zelle because of Wells Fargo On line otherwise Wells Fargo Online business is needed. To send otherwise receive money which have Zelle, both sides need a qualified checking or checking account. For your shelter, Zelle would be to just be used in delivering money to loved ones, members of the family, or someone else you believe.

When you are hitched/RDP and file a shared return, you need to contour the amount of excessive SDI (otherwise VPDI) individually for every companion/RDP. You don’t need to to make projected income tax money for those who try a good nonresident or the new resident from California inside 2024 and you will did not have a ca income tax accountability in the 2023. So you can claim that it borrowing, their government AGI have to be $100,100 otherwise smaller and also you need over and install form FTB 3506, Boy and you may Dependent Proper care Expenditures Borrowing. For those who received buildup withdrawals out of international trusts otherwise from particular domestic trusts, rating setting FTB 5870A, Income tax for the Buildup Delivery away from Trusts, to find the additional taxation. To avoid you’ll be able to delays inside the control your taxation go back or refund, go into the best income tax amount on this line. In order to instantly shape the income tax or to make sure your tax calculation, have fun with the on line taxation calculator.

- Whatever the state, talk to your own property manager about this before it get judge step.

- Wells Fargo investigates of many points to dictate the borrowing from the bank possibilities; therefore, a particular FICO Get otherwise Wells Fargo credit score doesn’t ensure a particular mortgage price, approval from that loan, otherwise an update to your a charge card.

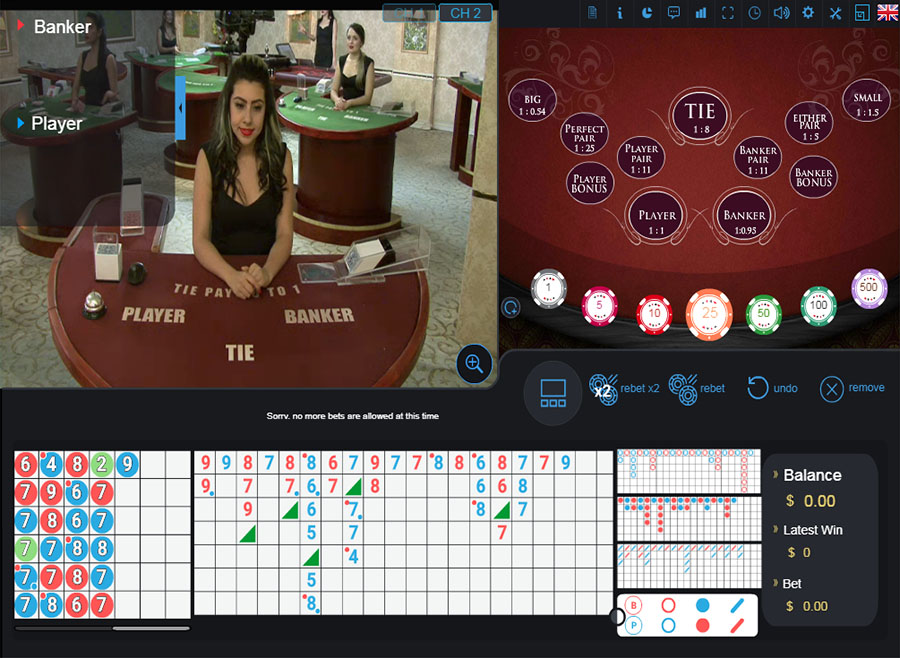

- All of our extremely detailed gambling establishment analysis and you may exclusive get program are built to really make it so easy to choose which option from a number of highly rated gambling enterprise websites tend to fit the best.

The termination of the firm date is referred to as the new « deposit cutoff time ». If you make a deposit ahead of the cutoff day to your an excellent working day we are unlock, we are going to believe one to date as the day of one’s put. Yet not, if you make in initial deposit once our cutoff go out or to your day we are really not open, we are going to think about the put becoming generated to the second working day that individuals is actually open. Make ends meet, transfer and you can receives a commission with your U.S. family savings and you can routing matter as a result of on the internet banking.

Extended waits will get apply

Cover the identity by creating only the history five digits of the Public Protection matter for the one consider or currency buy you posting for the Tax Service. You ought to are your entire Social Protection matter on your go back and payment coupon. Having a great $25 lowest opening put, you’ll take pleasure in benefits that include electronic cost management systems and much more. You are analyzed both a later part of the filing and you will underpayment punishment for many who file the get back pursuing the due date (otherwise lengthened deadline) and don’t shell out your taxation responsibility along with your get back.

- Someone who prepares the come back and won’t cost you shouldn’t fill out the fresh paid back preparer’s urban area.

- For brand new circulate-ins, participants have to apply, be considered, and get accepted for the tool without having to use it direction.

- Individuals are required to submit a rental ledger describing the previous owed equilibrium.

- You should note that some money things and you will line records applied to Form It-201 or Form It‑203 do not correspond with those found for the government Function 1040NR.

- This can be a nonrefundable tax borrowing from the bank out of $five-hundred per qualifying people.

Self-Employment Taxation

You should attach a totally finished Function 8840 to the earnings income tax go back to allege you may have a deeper link with an excellent international country or nations. You should earliest see whether, to have income tax objectives, you’re a good nonresident alien otherwise a citizen alien. Crisis income tax relief can be acquired of these affected by certain Presidentially declared disasters (come across Irs.gov/DisasterTaxRelief). Aliens who’re expected to document a great You.S. taxation get back may be influenced. To learn more, see the Instructions to own Function 1040, or even the Recommendations to possess Setting 1040-NR. Although we can be’t function individually every single review acquired, i do take pleasure in your viewpoints and can consider carefully your comments and you will guidance even as we inform the taxation versions, recommendations, and guides.

Really clients are so excited to go to the another put or troubled by moving process that they forget about when deciding to take the amount of time doing whatever have to do to help you help them manage to get thier deposit right back after. One which just flow your home into your the fresh lay, bring a few important moments to closely review the new apartment before you can move in. Department out of Property and you will Urban Development’s (HUD) Book Reasonableness Advice, ERAP may provide up to five times the brand new leasing matter dependent on the area area code and you will bedroom sized the brand new flat/house. Depositing bucks or and make a credit card put from the lobby kiosk is just one of the brand new choices for and then make a deposit. You’ll find charges because of it exchange you is actually notified to help you inside the put. Already, $two hundred is one of cash which may be placed for each exchange.

This can be one demand for real estate located in the United States or even the U.S. Virgin Islands otherwise people interest (aside from because the a collector) in the a domestic business which is a good You.S. property carrying corporation. Transport money (laid out within the part 2) are efficiently connected if you fulfill all of another requirements. Two screening, discussed lower than Funding Money, later on, determine whether certain bits of financing money (such attention, dividends, and you can royalties) is managed since the effectively associated with you to definitely business.

RentCafe Resident Site is actually an internet centre one addresses the citizen demands – from paying rent and submitting functions requests so you can signing up for renter crucial and you will generating benefits – the off their cellular telephone, tablet otherwise laptop computer. Sign up thousands of businesses worldwide you to favor Yardi property government application and functions to maximise every facet of their functions. That have No Responsibility shelter, you are refunded to own timely advertised not authorized card transactions, at the mercy of particular standards.

Alabama Leasing Direction Apps

Before you leave the united states, aliens need to essentially receive a certification of conformity. It file, and popularly known as the newest cruising enable or departure permit, falls under the cash tax setting you should file prior to leaving. You’ll discover a cruising or departure allow after submitting a great Mode 1040-C or Form 2063.